Published: August 15, 2018

TARIFFS

2018 marked a year of change in the United States’ long-standing tariff policies. For the first time in over 15 years, the federal government adjusted tariffs on core raw materials – mainly aluminum and steel – to correct a perceived trade imbalance. Although not yet fully implemented, tariffs range from 10% to as high as 25% on all major U.S. trading partners, regardless of existing trade agreements. However, Chinese imports are being hit hardest, with tariffs expected of up to $200 billion (for perspective, the US imported $505 billion of Chinese goods in 2017).

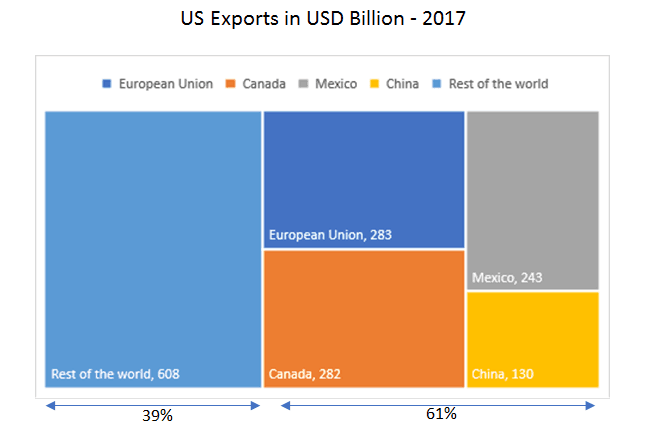

The final impact of these tariffs on the national and global economy is still to be measured, but economists agree it will be negative overall, with the degree varying by industry. Outcomes will depend greatly on potential retaliation and on the fast-changing global relations of the US with its largest trade partners: the European Union, China, Canada and Mexico. These four trade partners, as shown in the following graph, account for a combined amount of 61% of all US exports:

European Union: The 28-country trading bloc is the largest importer of US goods: in 2017 it received $283 billion of US exports (18% of total US exports). It is imposing retaliatory tariffs on hundreds of agricultural products (e.g., corn, rice), whiskey, tobacco products, clothing, steel and steel products.

Canada: Canada’s impact on US exports is almost as large as the EU’S, having imported $282 billion of US goods in 2017 (18% of total). Its retaliatory tariffs focus on steel and aluminum products but also extend to items such as food, paper and household appliances.

Mexico: The country’s southern neighbor is the third largest importer of US goods ($243 billion in 2017, or 16% of total US exports). It is imposing retaliatory tariffs on 3 billion goods, mostly agricultural products (pork, apples, potatoes and dairy).

China: The largest exporter of goods into the US is also the fourth largest importer of US goods ($130 billion in 2017, or 8% of total US exports). China’s retaliatory tariffs thus far focus on stainless steel pipes, wine and agricultural products (soy, fruit and pork).

Although exports were a large part of US GDP growth in the second quarter (caused largely by a surge in exports ahead of retaliatory tariffs from China), US companies are lowering their growth forecasts for Q3, as they expect continuing uncertainty and a challenging economic and political climate. This is despite the administration’s reassurance that Q2’s 4.1% GDP growth will continue.

MOST-AFFECTED MARKETS

Many sectors will be affected by the tariffs, but these seven will feel the most noticeable impact:

Agricultural Goods and Food and Beverage

Steel and aluminum tariffs are having a negative impact in the food processing industry, as they are raising the costs of canned products. And China’s retaliatory tariffs will have a negative impact on the agricultural sector, with soybean and pork producers being particularly affected.

- As the Department of Agriculture notes, soybeans are the second largest crop in the US. In 2016 the US sold China $14.2 billion worth of soybeans (61% of the US’s total soybean exports), making it the largest agricultural export to China. The industry outlook is not good, despite the subsidies announced by the current administration. Soybean prices in July dropped to a 10-year low, and the industry is changing on a global scale as China is finding new suppliers.

- The pork industry is being greatly affected by these tariffs. Pre-tariff hog prices were $76 per hundred pounds, but as of August prices had fallen around 20%, to $61 per hundred pounds. Given the importance of the Chinese market for American producers (in 2017 almost 60% of US exports of pork were destined for China) and the fact that China is producing more pork domestically and finding alternative suppliers, American pork prices are expected to keep falling.

- Canned products are suffering price increases, and these prices are being passed along to consumers. The two largest soft beverage companies estimate the tariff-related costs to b e about 10% for their canned products. This is being reflected in their prices. Another unwelcome effect of aluminum tariffs is that it is creating a can shortage, which has food processors looking into alternative packaging.

Proactive Worldwide can help clients find solutions for these issues by leveraging expertise in the agricultural and food processing markets.

Automotive

The mid-term impact of the steel and aluminum tariffs could be very problematic for the automotive sector. Not only will they raise prices for the end consumer, but they have also generated concern that new vehicle sales will decrease by about 10%. The Center for Automotive Research estimates that the proposed car components of tariffs could cause the average new US vehicle price to increase between $1000 and $4000.

The car manufacturing industry has already confirmed that it plans to pass tariff costs to the final customer and has lowered its outlook for 2018 earnings. This is in line with GM’s 2018 forecast announcement, which had an immediate effect, with the company stock dropping 6% that same day. Other companies such as Daimler announced that its car and truck units results in Q2 2018 were hurt by a €164 million rise in costs, and that it projects a €500 million rise in raw material costs for the full year.

Furthermore, the announcement that officials from Canada, the EU, Japan, Mexico and South Korea are currently in talks to align their strategies regarding car manufacturing and trade has domestic industry stakeholders worried, since it will likely have a negative impact on US manufacturing.

By leveraging its expertise in this area, Proactive Worldwide can provide research and strategic analysis about potential or future threats and opportunities.

Heavy Equipment

Despite the current good moment the equipment manufacturing industry is enjoying – fueled by strong demand from the oil, gas and mining industries and the construction boom in China – there are reasons to be concerned. An example is Caterpillar, the world’s largest manufacturer of heavy equipment, which recently reported a much higher than expected Q2 2018 earnings report. However, in that same report the company also warned that it expects material costs to increase hundreds of millions of dollars. Following the overall industry trend, Caterpillar has already raised prices that will help offset the higher manufacturing costs, and amid increased competition is challenged to find domestic alternatives to some its raw material suppliers that are being hit with tariffs.

Proactive Worldwide can help navigate this competitive market by identifying domestic sources of raw materials.

MROs

MRO companies as well as customers in the U.S. should be aware of the recent tariff trends. Most MROs have operations abroad, particularly in China. The current impact of the tariffs on $50 billion of Chinese goods ($34 billion have been already enacted, and $16 more billion are approved and scheduled to be enacted on August 23) is not yet very noticeable. It is being offset by a small increase in the price of final goods that is affecting customers, but overall demand remains strong due to the relatively inelastic demand in this industry. However, once the proposed second round of tariffs affecting $200 billion of Chinese goods is enacted, the impact will be much more noticeable, further increasing prices and likely causing shortages in certain product categories.

Proactive Worldwide has industry expertise to assist both sides of the market with guidance on strategy and risk mitigation measures.

Solar Panels

The solar panel industry was one of the first affected by the tariffs, and it is being affected twice: not only by tariffs on the panels themselves, but also by tariffs on steel and aluminum used to create the supporting structures. Due to recent changes in Chinese legislation that have discontinued the incentives for solar power installations, solar panel prices have fallen enough to compensate for the impact of the tariffs. For the time being the tariff’s impact is being compensated for by this price drop, but there is uncertainty about what direction the market will take later this year.

Proactive Worldwide has the market knowledge and capabilities to quickly anticipate market changes and provide clients with analytical solutions to any challenges that may arise.

Technology

The $16 billion in tariffs on Chinese goods that will be enacted on August 23 mostly target semiconductors. The Semiconductor Industry Association, which represents manufacturers and designers such as Intel, Qualcomm and Texas Instruments, stated that the tariffs will “undermine U.S. technological leadership, cost jobs, and adversely impact U.S. consumers of semiconductor products and the U.S. semiconductor producers.” Companies in the technology field also must consider the actions that countries like China can take against US companies, not only by instituting retaliatory tariffs but also by adding other retaliatory actions in what is known as qualitative tariffs. One example of this would be the botched acquisition of the Dutch company NXP semiconductors by Qualcomm on July 25. Qualcomm needed Beijing’s approval to the acquisition because the Chinese market accounts for nearly two-thirds of its revenue; Chinese authorities stalled the antitrust review, effectively killing the deal. Other technology devices such as activity trackers (e.g., Fitbit), Apple watches, and also e-cigarettes will also be affected if the proposed $200 billion tariffs are enacted.

Overall, this is a sector that is being negatively impacted by the tariffs due to the uncertainty they generate. However, the increased risks to current sourcing and manufacturing processes in the industry also create opportunities for companies to find alternatives and get ahead of the competition, something in which intelligence research – such as that provided by Proactive Worldwide – will be key.

Washing Machines

Washing machines were also included among the first round of tariffs. The initial outlook for domestic manufacturers was very positive, with stock prices increasing and announcements of increasing workforce to meet demand. However, this positive outlook swiftly changed when the steel and aluminum tariffs were announced, as these raw materials constitute the bulk of the appliances.

Between March and June the average cost of washing machines increased 17%. Demand is waning, which creates an even more challenging market environment in which competitive intelligence –one of Proactive Worldwide’s core capabilities – will be essential to stay ahead of the competition.

4 MORE WAYS PWW CAN HELP

Proactive Worldwide specializes in market, customer, and competitive insights that provide the intelligence that will keep you informed and Out in Front® of market developments. Find out how PWW can help you navigate sourcing, manufacturing and international trade challenges by:

- Providing insight on how competitors are adapting to the new trade realities and what that means to your specific organization.

- Executing studies that identify threats to current manufacturing processes being affected by the trade war.

- Identifying opportunities that arise in the market as well as competitors’ strategies.

- Understanding how the market is being transformed and identifying the actions needed to adapt to new realities.