Avery Ekman

Senior Analyst

Proactive Worldwide, Inc.

Published: April 24, 2024

Discussions around Environmental, Social, and Governance (ESG) practices in 2024 have shifted to the mainstream in the United States, a transition sparked by growing consumer awareness, ongoing legislative debates, and stakeholder advocacy. Three primary perspectives shape the evolving landscape: investors, state legislators, and consumers, each contributing to the complex narrative surrounding ESG’s optimal role in US capital markets.

Investor Perspective: A Nuanced View

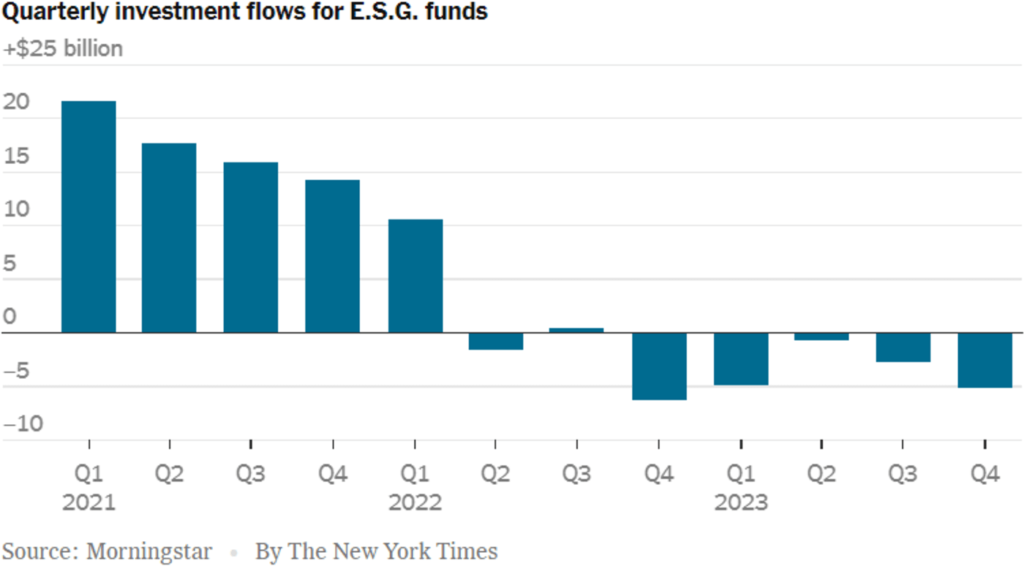

Shareholders and other equity investors have shown a cautious approach towards ESG investment. Despite larger ESG funds outperforming the S&P 500 in recent years, Morningstar Direct reports that poor ESG fund performance in 2022 and 2023 led to a retreat from sustainable investing, marked by four consecutive quarters of net outflows. These outflows indicate a modest drawback, influenced by factors such as market performance, sector allocations (notably energy light), and, most notably, skepticism about the effectiveness and impact of ESG criteria on long-term investment returns. Blackrock’s Larry Fink demonstrated this skepticism by withdrawing from a prominent iShares ESG fund.

State Legislator Perspective: A Divided Arena

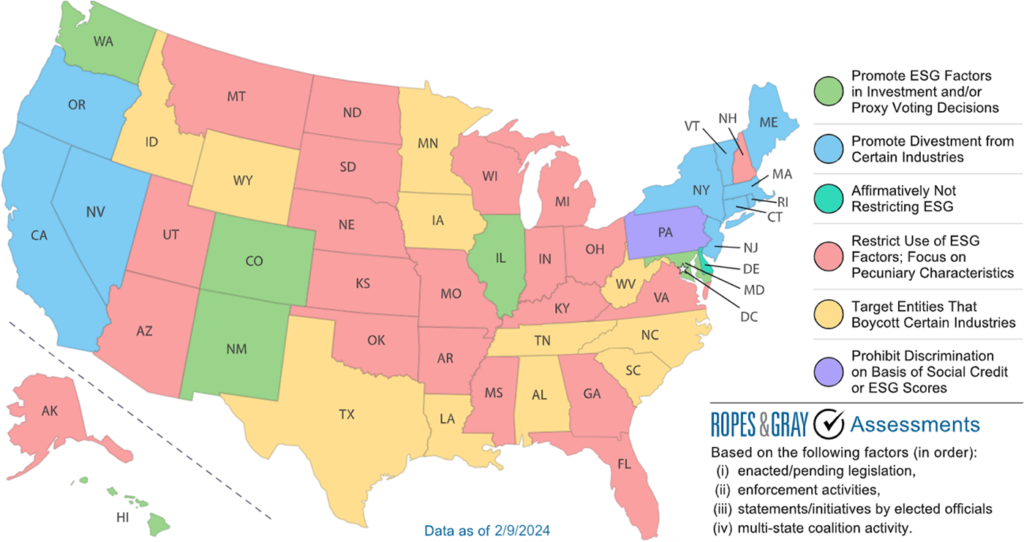

The legislative landscape is starkly divided along partisan lines, with at least 20 states, predominantly Republican-led, enacting measures to discourage ESG considerations in public investments. This thinking contrasts sharply with actions by states like New York, Colorado, and California, which have strengthened their ESG regulatory frameworks.

Consumer Perspective: Supportive but Conflicted

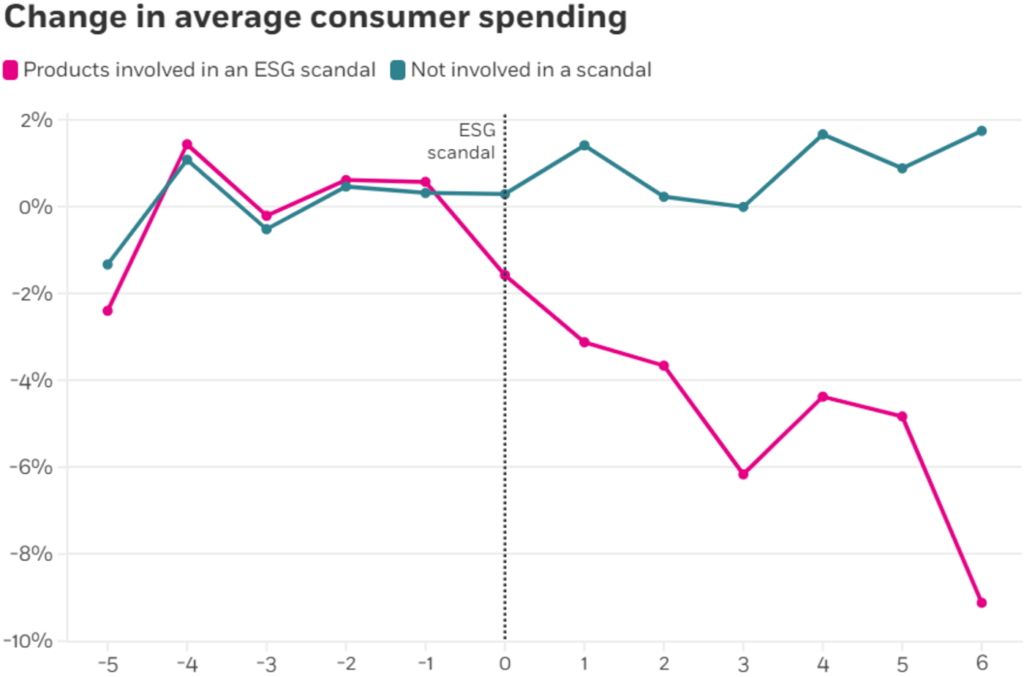

Consumers are both supportive of ESG principles and conflicted about their implementation. On one hand, a recent study by the Chicago Booth School of Business found that adverse reactions to corporate misbehavior suggest a baseline expectation for ethical conduct.

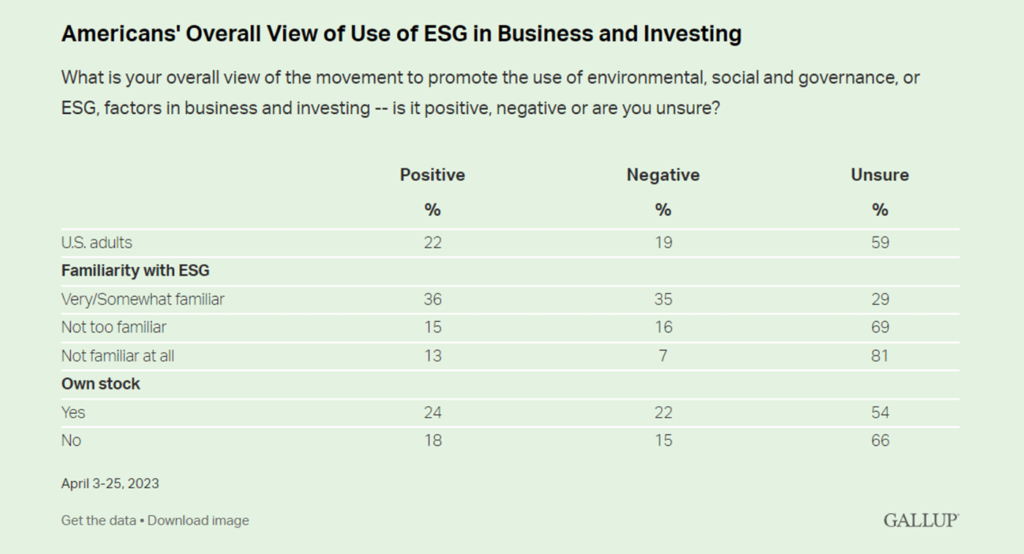

Yet, the need for clear consensus on ESG’s importance indicates varying degrees of understanding and priority, as in reflected by a 2023 Gallup poll.

The disconnect mirrors a broader challenge of aligning individual values with collective action, particularly in a country as diverse as the United States.

Conclusion

ESG in the US appears poised at a critical juncture, with its future likely to be shaped by domestic politicization, legislative actions, and changing public opinion. While ESG investment practices face headwinds, they also offer potential benefits as a business practice, embodying popular values such as environmental stewardship and diversity. The ultimate acceptance and integration of ESG principles into US capital markets will depend on navigating these complex and often contentious debates.